By R. J. “Jim” Sewell, Jr., MTADA General Counsel

It goes without saying that perfection of the lender’s lien on vehicles financed is a big deal. As we’ve stated in this column in the past the process is very simple. Always put the lien on the TRP. In most cases once the TRP is issued with the lien included and the fee is paid by the charge to the dealer’s account the job is complete and your contractual obligation to the purchasing lender has been accomplished. Bruce and I confirmed this fact during a conference call with the DMV just recently.

Over the past couple of months multiple dealers have contacted Bruce and me about correspondence or telephone calls from their lenders demanding that the dealer see to it that “. . the title is issued with the lien shown . . .” for a financed vehicle and in some cases demanding the Retail Installment Sale Contract be repurchased if it is not.

It is important to understand exactly what your contract with the lender says you must do. Those I have read, like Ally, FIB, and most others I believe, require that the lien be perfected by the dealer. So the first step is to find your agreement with the lender and understand what the language of that contract requires. Those that I have read all have similar language to the following taken from a current Ally Retail Plan Agreement:

Section 4. Registration and Titling. Dealer shall promptly register and title vehicles sold pursuant to a Contract in a manner sufficient to perfect in Ally’s favor a valid and enforceable first priority security interest in the vehicle. Dealer shall promptly complete the necessary forms and documents at the time of sale and forward them together with the appropriate fees to those public officials who are responsible for issuing the certificate of title or registration. If a first priority security interest in the vehicle is not perfected within ninety (90) days of Contract consummation, Dealer shall accept reassignment of the Contract and pay the full amount of the unpaid balance under the Contract to Ally upon demand.

You will see that the Ally contract language mentions “register and title” but the important language is the reason for the requirement – to perfect Ally’s first priority security interest. Although a lender may say that the dealer must see to it that the vehicle is registered, in Montana (other states where the lender uses the same agreement form may be different) registration has nothing to do with perfection of the lien or the lender’s security interest in the vehicle and it is a task totally out of the dealer’s hands. Under MT law the owner must register the vehicle. It is not something the dealer can or must do. Here is the statute:

61-3-303. Original registration — process — fees. (1) Except as provided in 61-3-324, a Montana resident who owns a motor vehicle, trailer, semitrailer, or pole trailer operated or driven upon the public highways of this state shall register the motor vehicle, trailer, semitrailer, or pole trailer in the county where the owner is domiciled.

The lien is perfected when the electronic file with the lien on it is transmitted and the fee is paid as a part of issuing the TRP. These steps are described in the statute:

61-3-103. Filing of security interests — perfection — rights — procedure — fees. (1) (a) Except as provided in subsection (2), the department, its authorized agent, or a county treasurer shall, upon payment of the fee required by subsection (8), enter a voluntary security interest or lien against the electronic record of title for a motor vehicle, trailer, semitrailer, pole trailer, camper, motorboat, personal watercraft, sailboat, or snowmobile upon receipt of a written acknowledgment of a voluntary security interest or lien by the owner of a motor vehicle, trailer, semitrailer, pole trailer, camper, motorboat, personal watercraft, sailboat, or snowmobile on a form prescribed by the department.

(b) After the voluntary security interest or lien has been entered on the electronic record of title for the motor vehicle, trailer, semitrailer, pole trailer, camper, motorboat, personal watercraft, sailboat, or snowmobile, the department, its authorized agent, or a county treasurer shall issue a transaction summary receipt to the owner and, if requested, to the secured party or lienholder, showing the date that the security interest or lien was perfected.

(c) A voluntary security interest or lien is perfected on the date that the department, its authorized agent, or a county treasurer receives the written acknowledgment of the voluntary security interest or lien from the owner of the motor vehicle, trailer, semitrailer, pole trailer, camper, motorboat, personal watercraft, sailboat, or snowmobile.

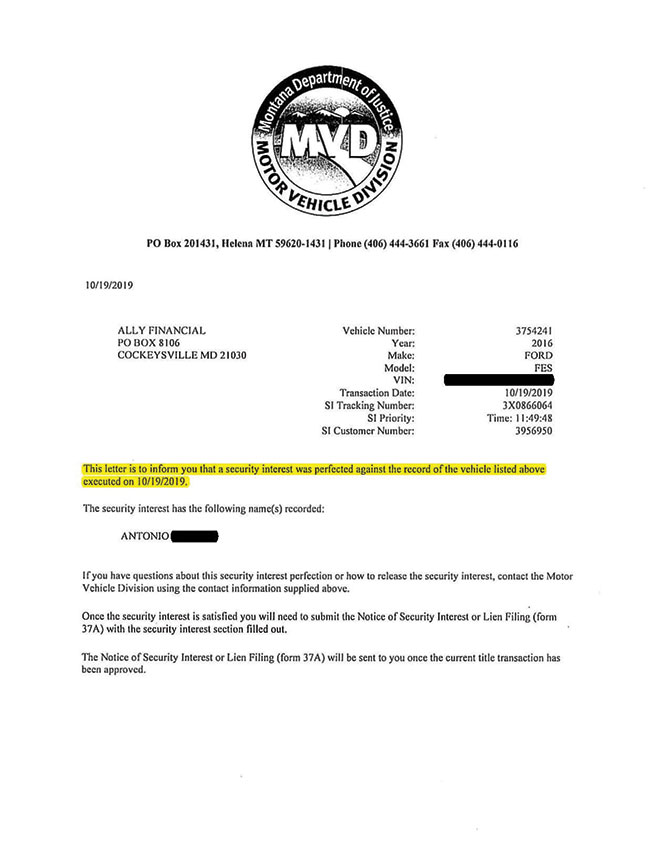

Acknowledgement that this step has been completed is the letter from DMV sent to the lender stating the date the lien was perfected and noting that fact on the DMV electronic record. Here is a sample of the DMV letter. Note that the letter is sent directly to the lender and states the date that the lien was perfected just as required by part (b) above. You can obtain a copy of this letter from the DMV electronic records if it becomes necessary for you to send it to the lender representative that has contacted you.

As you can see from the referenced statutes, once you have issued the TRP with the lien included your obligation to your lender to perfect the lien has been satisfied. If demands that you see to it that the vehicle is registered persist, I suggest you write the lender sending them a copy of the lien acknowledgement letter from the DMV as proof that you perfected the lien and a copy of Section 61-3-103 and 61-3-303 which makes it clear that you have done your part, the owner is required to register the vehicle and that you as the dealer have no role in the registration process.