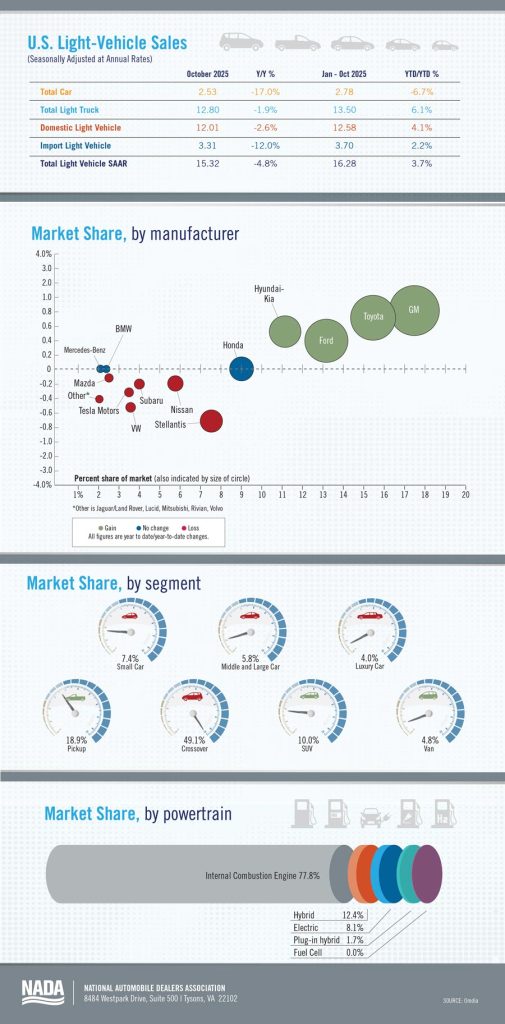

New light-vehicle sales in October 2025 recorded the lowest SAAR in 15 months. The October 2025 SAAR of 15.3 million units represents a 4.8% decline year over year and a 5.9% decrease compared to September 2025. The SAAR decrease was primarily driven by the decline in battery electric vehicle (BEV) sales, which fell significantly in October 2025 following the end of the EV tax credits on Sept. 30.

BEV sales represented just 5.9% of new-vehicle sales in October 2025, down from the all-time high of 11.3% in September 2025. BEV sales in October 2025 totaled just under 75,000 units, representing a 46.7% decline compared to September 2025 and a 23.8% year-over-year decrease. The expiration of the EV tax credits in September accelerated many EV sales that would have likely occurred later. The decline in BEV sales could have been more severe without several OEMs increasing their own incentives in October to help offset the loss of the federal credit. According to J.D. Power, the average incentive spending per unit on BEVs totaled $13,161, up $2,047 from September 2025. It remains to be seen what the natural demand for BEVs will be in the absence of the credit, but we expect it will take some time for BEV sales to reach the rate they were at in the final months of the EV tax credits.

Our outlook for the rest of the year is for a slower sales pace relative to Q3 2025. Given the pull-ahead sales that occurred earlier this year, a slower Q4 won’t necessarily impact full-year sales totals too much. We expect sales to be flat or up slightly compared to full-year 2024.