Manufacturers supplying warranty parts at zero cost or on an “exchange” basis is a practice that has been around for a long time. However, this continues to be a misunderstood topic in terms of how the manufacturers actually compensate for these parts versus how they are required to compensate the dealer under various state laws. This practice, where manufacturers supply high-ticket parts to dealers at no cost, has become more common. While this approach might appear beneficial to some on the surface, it often results in financial challenges for dealers, who receive minimal handling allowances instead of a retail markup. This article explores the complexities surrounding zero-cost parts, focusing on the legal landscape in states like Montana, where specific provisions exist to ensure dealers are compensated fairly. We delve into the process, the challenges dealers face and the potential strategies you can employ to secure the retail markup dealers are entitled to by law.

Zero-Cost Part Provision Concept

Manufacturers sometimes supply warranty parts to dealers at zero cost or on an exchange basis. This can vary from manufacturer to manufacturer but typically includes high-ticket parts such as radios, navigation units, transmissions, engines and EV batteries.

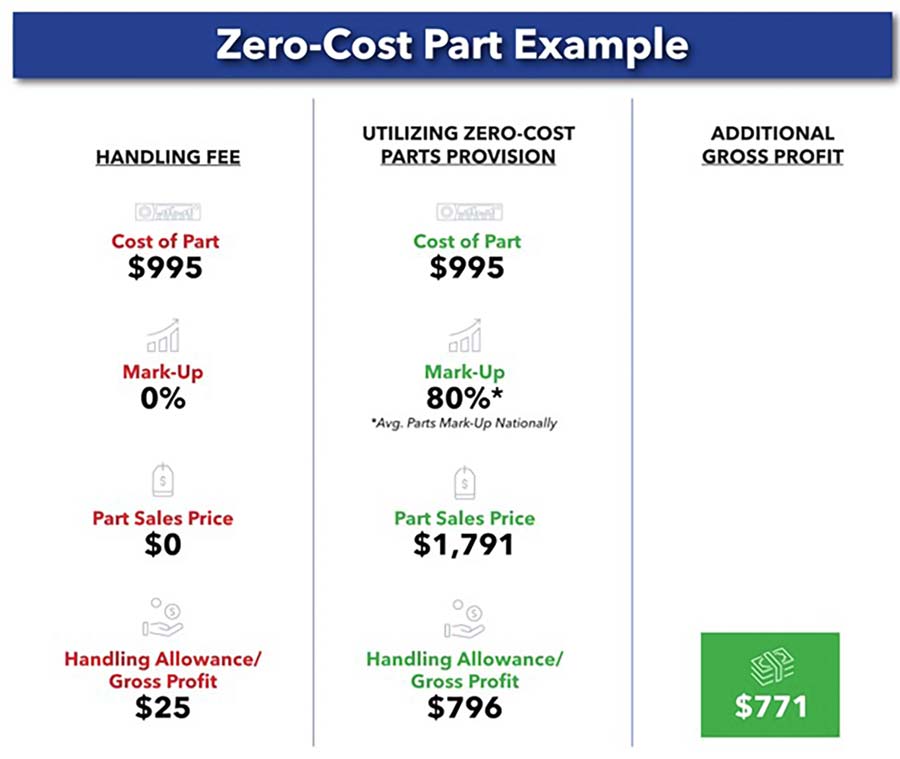

When it comes to these “exchange components,” manufacturers have historically only paid a handling allowance, which can range from approximately $25 to $450, depending on the part. However, there are currently 27 states, including Montana, that mandate both warranty parts reimbursement at retail rates and have a specific zero-cost parts provision. This statutory mandate requires a manufacturer to compensate for ALL parts at a retail markup, and therefore only providing a handling allowance is in contravention of such mandate.

The concept is simple: If a warranty part is provided at no cost, the manufacturer is still required to compensate the dealer at their retail markup based on the cost of the part as listed in the manufacturer’s price schedule. The realization of this reimbursement can be anything but simple, depending on the manufacturer and state. While certain parts may be supplied at no cost due to legitimate factors, there is a growing concern among dealers that many high‑cost parts are being supplied at no cost solely to circumvent paying retail markup.

The Process

Unfortunately, the process is all over the board, depending on the manufacturer and state. Some manufacturers have procedures in place that allow the dealer to easily submit their claim and receive retail reimbursement. Of course, some manufacturers may be willing to pay for most zero-cost parts but may balk with respect to EV batteries, which has been a huge point of contention nationwide. Many also seem to have nearly no formal process in place and will often make it difficult to obtain information on how to properly submit the warranty claim. Of course, this may be by design in many cases.

A good starting point for a dealer would be to reach out to their regional representative in the process of determining how to submit for retail reimbursement on exchange parts. Most likely, this will be some form of manual submission. A point of caution would be to ensure how the claim is characterized by the manufacturer so that it doesn’t impact your warranty expense report (EPVS/CPVS), which could affect your warranty expense calculation and could ultimately lead to an audit.

Reimbursement Example

The following is an example of a radio that a particular manufacturer supplies at no cost. The wholesale cost of this part is $995, but the handling allowance is a measly $25. Luckily, in Montana, you are entitled to your full retail markup on ALL parts. This means a dealer with a markup of 80% would net $771 in additional gross profit on this part alone. When you consider all exchange components, a dealer could be looking at many thousands of dollars per year in additional profit that could be put to good use, such as helping to pay and retain quality technicians.

The Bottom Line for Montana Dealers

The law is clear that you are entitled to retail reimbursement on exchange components. But while this particular provision in the law is designed to be self-effectuating, many manufacturers will interpret it otherwise, meaning you must “ask” for the reimbursement to receive it. For some lucky dealers, their experience is that if they ask, their manufacturers may simply comply. In other cases, dealers have had to send in a letter on their letterhead or attorney letterhead; some that took this step have found success, while others have indicated that “it’s impossible.” In such cases where you have exhausted all your practical resources, you will need to make a business decision as to whether to pursue your rights legally. While suing your manufacturer, or at least threatening to do so, is neither desirable nor preferable, there may be no alternative with respect to a manufacturer who is not complying with the law.

But there’s clear evidence that some dealers are receiving retail reimbursement on many or all exchange components, with the possible exception of EV batteries, without resorting to litigation or the threat thereof. Some dealers asked for reimbursement and are collecting significantly more gross profit without pushback or retribution from their manufacturers. While the process of securing fair reimbursement for zero‑cost parts can be complex and varies widely depending on the manufacturer and state, by understanding your statutory rights and taking the necessary steps to request retail reimbursement, dealers can potentially significantly enhance their profitability and ensure they are compensated fairly for the parts they provide during warranty repairs.

Jordan Jankowski is the chief operating officer at Armatus Dealer Uplift. He has played a key role in consulting on 18 warranty reimbursement laws across the country and is widely considered a subject matter expert in this highly technical arena. Jordan manages a team of over 60 people who produce thousands of retail warranty reimbursement submissions each year.